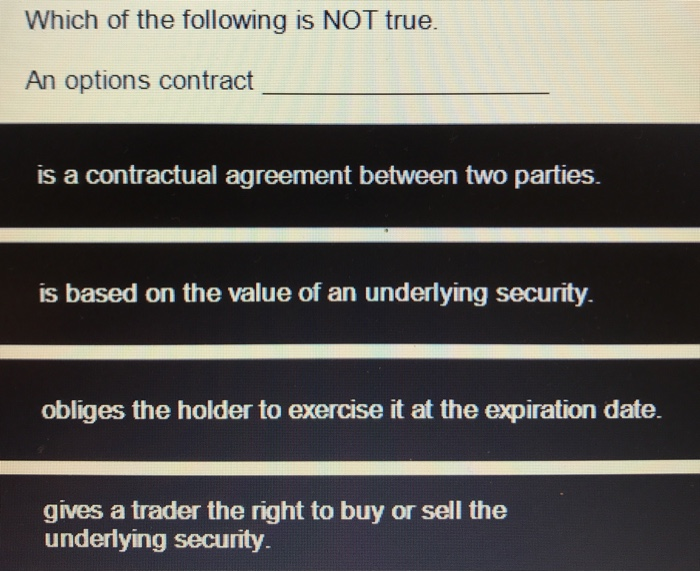

Which of the Following Is Not True. An Options Contract

Stock-index options enable investors to trade on general stock market movements. Total loss 300 100 x 3.

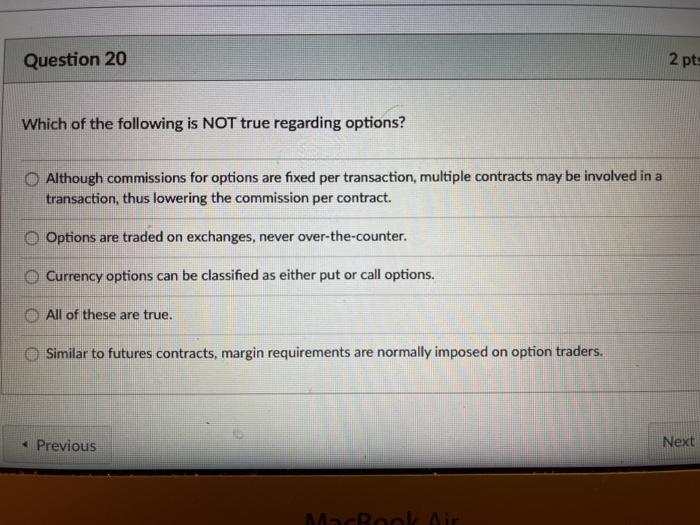

Solved Question 20 2 Pts Which Of The Following Is Not True Chegg Com

The offer cannot be revoke during the option period.

. An American option can be exercised at any time during its life B. An attractive feature of owning an option is that you can sell it before expiration. If money is paid as consideration then that is not applied to the sale price.

Death or incompetency of either party terminates an option contract. In Canada stock-index options trade. C The holder of a call or put option must exercise the right to sell or buy an asset.

A put option will always be exercised at maturity if the strike price is greater than the underlying asset price. A When an IBM call option is exercised the option seller must buy shares in the market to sell to the option buyer. The price of a call option increases as the strike price increases.

The buyer of a call option has the right to buy the currency at the strike price. It is a life contingency option. Futures contract often have a range of delivery dates.

An investor sells a futures contract an asset when the futures price is 1500. If the offeree chooses not to buy the property then money paid in consideration must be returned B. Use of multi-year contracting is encouraged to take advantage of one or more of the following.

Which of the following is NOT true of options. Which of the following is true about an option contract. BFutures contracts are standardized.

The price of a call option increases as the strike price increases E. An options contract is an agreement between two parties to facilitate a potential transaction involving an asset at a preset price and date. A the optionee can enforce the sale.

CDelivery or final cash settlement usually takes place with forward contracts. The writer of a call option has the obligation to sell the currency to the buyer if the option if exercised. Answers B C and D.

Is based on the value of an underlying security. Investors must pay an upfront price the option premium for an option contract D. All of the following are true regarding a decreasing term policy EXCEPT.

Which of the following is NOT true about call and put options. C Reduction of administrative burden in the placement and administration of contracts. If a stocks price were to rise within a short timeframe a call option would likely provide a greater return than a margin trade.

The payable premium amount steadily declines throughout the duration of the contract. An options contract is a contractual agreement between two parties. DForward contracts usually have one specified delivery date.

AAn American option can be exercised at any time during its life B. A European option can only be exercised only on the maturity date C. With options you are insured so to speak against missing out on a.

The contract is worth zero if the price of the asset rises after the contract has been entered into 8. An American option can be exercised at any time during its life B. D the optionor cannot require specific performance.

D Substantial continuity of production or performance thus avoiding annual startup costs preproduction testing costs make-ready. IBM is not involved in any way. B the option money is usually forfeited if the purchase is not completed C the optionee must sign the contract.

The buyer of a put option has the right to sell the currency at the strike price. The same is not true of futures contracts. Each contract is on 100 units of the asset.

Directors owe the corporation a fiduciary. Which of the following is NOT true regarding options. A European option can only be exercised only on the maturity date C.

B A put option gives the holder the right to sell an asset by a certain date for a certain price. Which of the following is NOT true A. A put option gives the holder the right to sell an asset by a certain date for a certain price C.

All of the following statements are true regarding installments for a fixed period annuity settlement option EXCEPT. Which of the following is not true concerning stock-index options. The contract is closed out when the futures price is 1540.

Call options can be purchased as a leveraged bet on the. All of the following are types of traders in futures forward and options markets EXCEPT. Forward contracts are not.

Stock-index options are available on the SPTSX 60 and various ETFs. Insurance company agrees to safeguards the insured to put him in the same position that heshe would have been in if the loss had not occurred. If the contract is for 100 options.

Which of the following is not a duty of the directors. Gives a trader the right to buy or sell the underlying security. Investors must pay an upfront price the option premium for an option contract D.

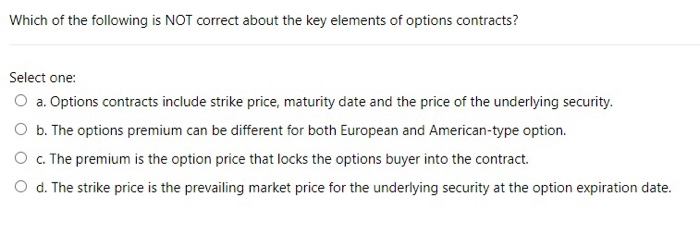

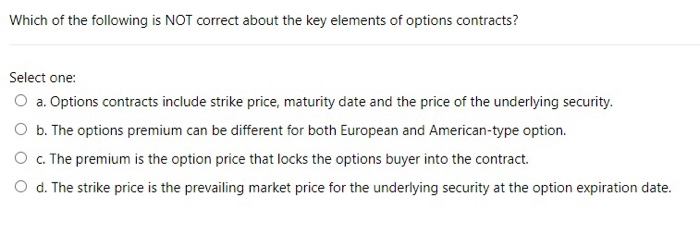

All of the following are true concerning an option contract EXCEPT. D The holder of a forward contract is obligated to buy or sell an asset. Which of the following is NOT true about call and put options.

Which of the following is NOT true about call and put options. A A call option gives the holder the right to buy an asset by a certain date for a certain price. Approve the share certificate Issue shares Appoint the officers Vote in new directors Set up banking Question 2 1 point Which of the following is not true regarding the role of the directors of a corporation.

Most index-options are European style including the SPTSX 60 Index options. Which of the following is true A. A European option can only be exercised only on the maturity date CInvestors must pay an upfront price the option premium for an option contract DThe price of a call option increases as the strike price increases.

Thus there will be a cash outflow of 3 per option. Fire Insurance is a contract where one party agrees to indemnify the loss of other party at the time of loss for a consideration. B Enhancement of standardization.

The holder of a call or put option must exercise the right to sell or buy an asset D. Fire insurance contracts runs on the principle of indemnity. Which of the following is NOT true.

Therefore net loss 3 5-2. A call option gives the holder the right to buy an asset by a certain date for a certain price B. Obliges the holder to exercise it at the expiration date.

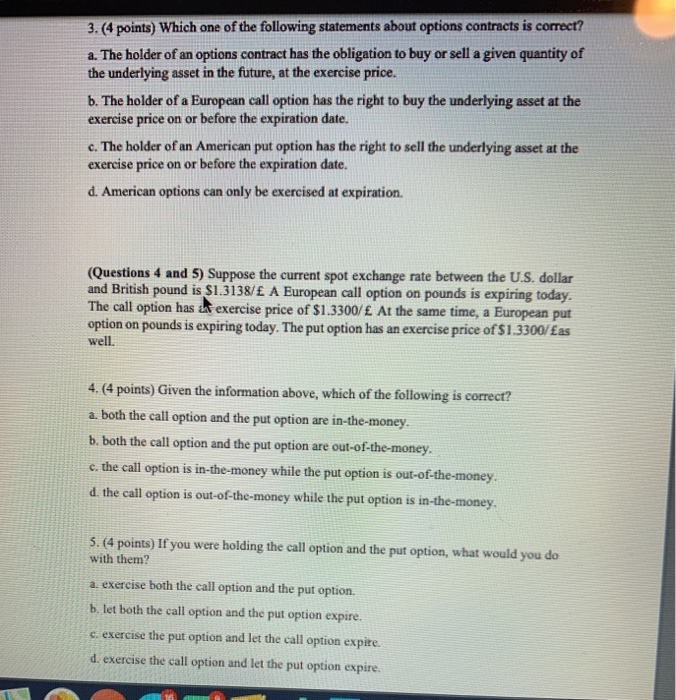

Solved 3 4 Points Which One Of The Following Statements Chegg Com

Solved Which Of The Following Is Not Correct About The Key Chegg Com

Solved Which Of The Following Is Not True An Options Chegg Com

0 Response to "Which of the Following Is Not True. An Options Contract"

Post a Comment